Module 4 – 41 Applying Gann’s Price Ranges and Levels.

Applying Gann’s price ranges and levels

By learning Gann’s theory, you would have gathered the required information to use it in trading. We have covered another section by explaining the ways to use Gann’s theory in trading. By reading both the chapters related to Gann’s theory, you can gather the idea of what it is. But now, let’s discuss the ways to apply Gann’s price ranges and levels in trading.

Accept the Gann’s theory

Even though Gann’s theory was famous and useful, only a few traders were able to understand the benefit of it. Even now, only some traders use this theory to trade. If you want to take the maximum benefits of available opportunities, it is essential to accept the Gann’s theory.

Actually, Gann lines mean support and resistance lines; they are not predictive. When you are trading, you will be doing it along with an inherited risk. The price movement mitigates the risk. Therefore, when you are trading on Gann levels, it is essential to focus on the stop and risk management concepts.

So, the concepts of management and stop-loss are to be entirely understood if you want to get the best out of Gann’s levels.

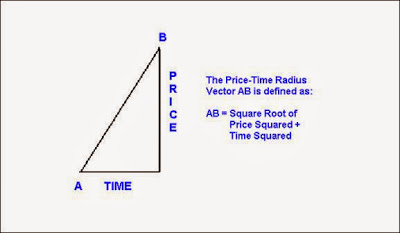

Squaring of time and price

As for Gann’s theory, squaring time and price are essential. Gann has mentioned, if a person sticks to the rule and be watchful of price and time squaring and vice-versa, the trader can forecast the crucial changes in trend while ensuring accuracy.

The squaring of time with price defines an equal amount of points down or up, balancing the number of time periods. Gann’s advice is to square the low prices, high prices, and range.

Squaring the Gann range

The squaring of the Gann range will be provided when the Gann angles presented inside a range, and the trader gets to view the graphical representation. For example, a range of 100 in the market has a 1 point scale, the Gann angle will be moving up starting from the range bottom at 1 point and will reach the top range in 100 periods. When this happens, a bottom, top, or trend change is expected. You might encounter this cycle over and over as long as the market limits within the range.

Squaring a Low

This means that a similar amount of time has been spent from the time the low was created. This happens when the angle moves up, starting from the bottom reaches the time similar to the low. For example, assume that the low price and the scales are 100 and 1 respectively, then, ultimately, 100 time periods uptrends Gann angle by reaching the square itself. You must be watchful of a bottom, top, or trend change when you focus on this. The squaring of low will persist until the market holds the low.

If you check the zero-angle chart in Gann charts, you can find the graphical presentation of the above-explained situation. The up-trending angle gets created in this chart from 0 prices at the low time occurrence and builds it up at one unit per time. However, you must remember, when the angle meets the original low price, you are likely to experience a bottom, top, or trend change. Therefore, you must expect to encounter one of these.

Squaring a High

This means that a similar amount of time has been spent from the time the high was created. This happens when the angle moves down, starting from the top reaches the time similar to the high. For example, assume that the high price and the scales are 500 and 5 respectively, then, ultimately, 100 time periods downtrends Gann angle by reaching the square itself. Nevertheless, you must be considerate about a bottom, top, or trend change when this happens. Also, the market will persist until it holds high.

If you check the zero-angle chart in Gann charts, you can find the graphical presentation of the above-explained situation. The up-trending angle gets created in this chart from 0 prices at the high time occurrence and builds it up at one unit per time. Anyway, when the angle meets the original high price, you are likely to experience a bottom, top, or trend change.

So when a trader focuses on time analysis, he or she must make sure to learn the market swings, cycles, anniversary dates, squaring of time and price, and trend points to determine the decision.

Wrapping up

We wouldn’t say Gann Theory or squaring price ranges and levels are easy because they are not! But you have to keep learning if you want to master at trading. No matter the type of market you select, education is essential for all the markets. Hence, keep educating yourself as much as you can.