Module 5 – 47 Phases of the market.

Phases of the market

We have come to the final stage of the course, Module five. In this section, our first chapter would be about the phases of the market. Before we begin explaining the phases of the market, you should understand the market cycle. In this cycle, the bull markets will mature and then reverse into bear markets in which the bull markets’ excess would have been corrected. Since the market speculation, these cycles have been opening up in different ways.

Even though two market cycles don’t look alike or they don’t share the exact underlying drivers, there are similar characteristics due to market psychology and human nature. However, if you want to trade the market like a pro, you must learn the phases of the market.

A trader’s success relies on the depth of understanding

If a trader needs to trade successfully, it is essential to understand the market conditions, market phases, and much more. Even if you understand the market phases and trade, you must know that no trading strategy guarantees 100% success. Therefore, don’t try to fight the market if things go wrong at times. Let’s get started with learning the market phases.

Phase 1- Range-Bound Markets

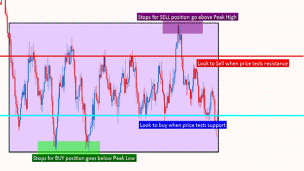

The price channels are the highlighters of ranges. When the market condition is ranging, the price will adhere to the support and resistance boundaries. This will help the traders to follow the buy low, sell high mantra.

These ranges are standard in congested periods or quite markets. These markets will not have adequate information for the traders to make a decision. They will not be able to move the price higher lower below support or above resistance. You can check the chart below to find the range that is displayed with price action.

Sadly, you can’t hold on to ranges forever because they don’t last long. More often, you will come across recent news that impacts the market. The traders will decide by considering the impacts on the market. Unpredictable moves highlight these markets.

Phase 2- Trading Breakouts

After resistance or support is broken, the price will continue to move for a prolonged period. So, trading breakouts is when looking to enter into trades by determining the breaks of resistance or support. Frequently, pre-set orders help the traders when the open trades hit prices. So, entry orders are considered the way of the trading breakout.

When determining breakouts, it is essential to know that no trader knows when or how resistance or support might be broken. Therefore, you can’t decide the way a breakout happens before it actually takes place. Also, you can’t find the direction that the price continues when resistance or support is broken because it is not possible.

Even though this is an uncertain situation, there’s good news. If the trader successfully trades a breakout, the price will continue for a prolonged time. This will allow the traders to add up several pips. You have to be careful when trading breakouts because traders are often wrong when they trade this phase.

The following picture indicates a classic breakout.

Phase 3- Trends

This is the best phase of the market because traders consider trends as their best friend. Trends offer a bias overlook so the traders can enter into trader effortlessly when compared to other ways. However, that doesn’t mean it is going to be with zero drawbacks.

Trend traders anticipate major levels of resistance or support to be broken. Once this happens, the trend will be exhibited clearly on the chart.

The following chart shows both an uptrend and a downtrend:

A highlighted series of lower highs and lower lows will indicate downtrends. Meanwhile, a series of higher highs and higher lows will indicate uptrends.

You can find a few ways to quantify a trend. Most traders consider moving averages to identify trends. However, some traders ignore indicators altogether and focus on price action alone.

There we covered the phases of the market. But remember, in Forex, you can keep learning as there is so much to learn.

Wrapping up

As humans, you are likely to be considerate about perfection. But as traders, you shouldn’t do this because it is not possible in trading. If you want to trade the Forex market as a beginner, you must be considerate of the phases of the market along with many other factors that we already discussed, and we about to discuss in the future.