Module 5 – 56 Strategies for combining price and pattern to increase profits.

Strategies for combining price and pattern to increase profits

This is the last chapter of our course, and this will be about the strategies for combining price and pattern to increase profits. Patterns and price are the most crucial factors in trading. Therefore, we will learn them below. If you want to make profits from patterns and prices, you need to be generous with the strategies that you use.

Despite the time frame that you are trading in, you must have a proper understanding of the trading pattern. If you want to make profits from trading, you need to differentiate good and bad trades.

Above all, if you have the confidence in trading, you can make it work. The traders who make excellent profits are the ones who have a higher level of confidence. Once you gain confidence, you will be able to increase the rate of success. You will not think twice to get out of a trade if you are confident. Anyway, let’s continue reading to learn more.

Why should a trader learn candlestick patterns?

Every trader who is looking forward to trade like a pro trader needs to know candlestick patterns. If you consider charts like bear flags, bull, or head and shoulders, they will not help you understand the market sentiments. But if you analyze candlesticks, you will be able to understand the sentiments of the market.

We will help you with the most popular candlestick patterns. Once you learn these, you will understand the ways to make these candlesticks lucrative. You will be coming across the bar and candlestick throughout the course. An inside bar or pin bar can be named as inside candlestick or pin candlestick, but you are unlikely to find these names. We’ll mention more information below.

Pin bars can signal the turning points

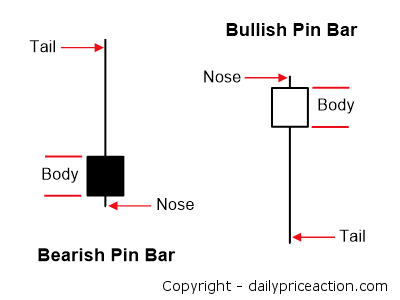

The pin bar is widespread, and like all the other formations, you can find both bearish and bullish signal. The following picture will help you understand what we are discussing.

These are beneficial in trading, but you must know the components of them clearly. Therefore, we’ll help you understand them. Only if you understand and analyze candlesticks, you will be able to make profits from it. The pin bar’s tail is a shadow or wick that focuses on the critical elements of patterns. The tail should consume two-thirds, and it’s the general rule. If you check the above image, you will understand it better.

The body of the pin bar is what focuses on the close and open section. It can differ in size. The close and open shouldn’t have a big gap. Moreover, keeping you on the track is a tail’s duty. The body must be small if two –thirds belong to the tail.

And then comes the nose, this is not visible sometimes.

However, it is crucial because it deals with the body and tail. If you find 2/3 tail, close and open near one another, then you don’t have to worry about the nose as much. Nevertheless, it is always better to know the characteristics.

Inside bar and continuation

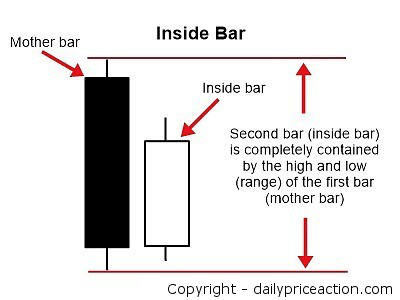

Traders often don’t understand the inside bar even though it is simple. Just because they are simple, traders often overlook insider bar pattern. The following picture will help you in learning this better.

The high to low (range of the inside bar) must be consumed fully by the scope of the previous bar. This is named as mother bar. In other words, the mother bar must consume the inside bar’s range.

Not understanding engulfing bar reversal

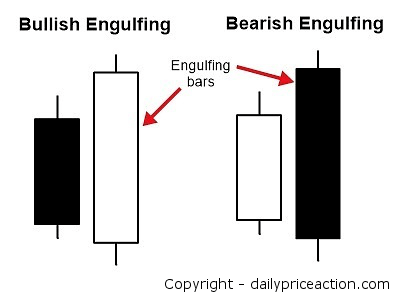

This is the final essential pattern that you need to know. This is opposite to the inside bar because the signals shown are reversal. Traders often misunderstand this because the pattern must focus on resistance and support level right after the prolonged move. However, a profitable scenario is formed only when the pattern creates swing low or high. If you witness this, you can make a trading decision.

You can see how this pattern engulfs the range of the previous bar. Therefore, it is considered lucrative. If you utilize it properly, the benefit can be immense. Some of the things that you must know if you want to profit from this pattern are:

- Can find the forthcoming reversal

- You need to make use of daily time frame right after a prolonged move down or up

- If you are using it as an entry signal, the stop loss must be above high of engulfing bar. This is applicable for bearish, whereas for bullish, it should be low instead of high.

- You can consider combining suitable techniques and methods to set up a higher probability.

That said, you should not forget that a higher level of patience is the key to success in trading. If you learn everything we’ve mentioned in the course, you will be able to become a good trader.